Shift from legacy to modern car rental software platforms

The car rental industry is undergoing a critical transformation. Legacy systems, once built for internal process control, are proving insufficient against rising user expectations. Today, platforms like Sharefox’s vehicle rental software are enabling rental companies to manage their fleets, customer flows, and digital channels with far greater efficiency.

Companies like Enterprise and Hertz have built infrastructure over decades, but their technology stacks often struggle with flexibility and integration. In contrast, newer platforms offer digital-first interfaces and automation layers, enabling smaller rental agencies to compete with national brands by deploying modern self-service experiences and fully online booking.

Features that define top car rental platforms

To understand what separates the best car rental companies in 2025, we need to look at the platforms they operate. Key features include:

These elements enable rental companies to move beyond one-time rentals and into long-term relationships with customers through digital touchpoints.

Why fleet automation matters in 2025

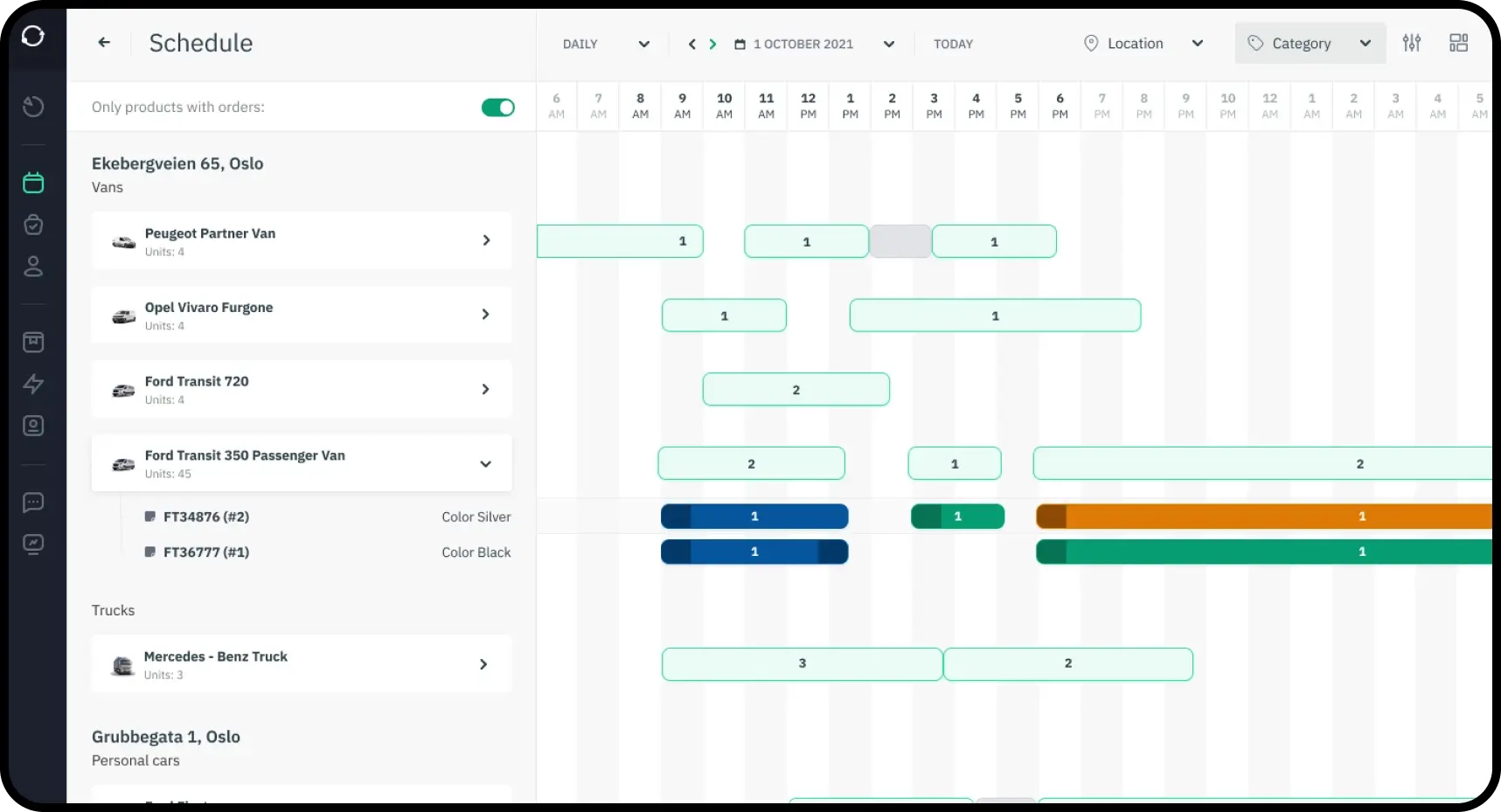

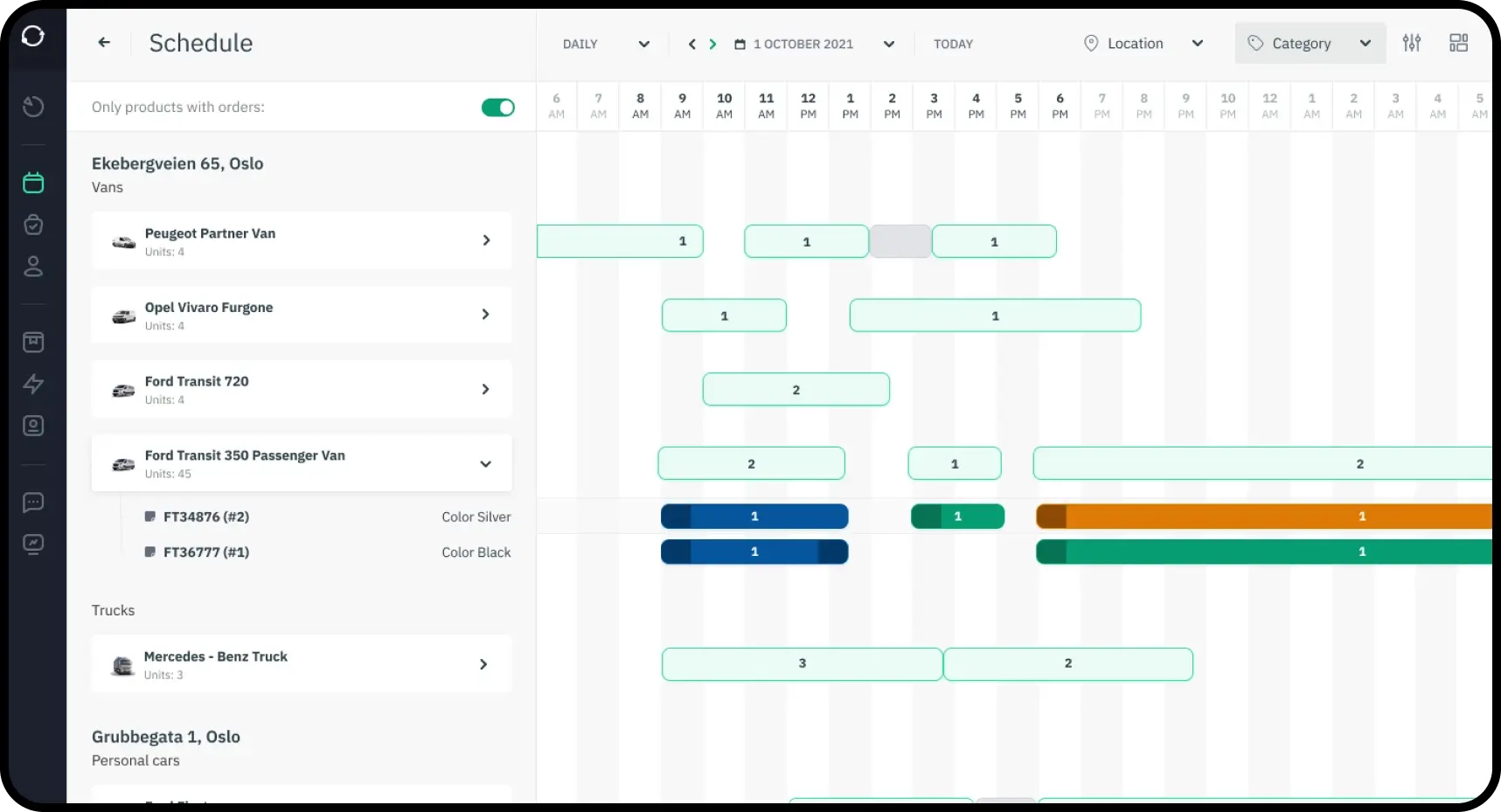

With increasing vehicle costs and higher operational risks, managing vehicle distribution and utilization is critical. Car rental providers are implementing fleet automation tools to handle logistics in real-time. Systems like Sharefox Inventory Rental Management support this by syncing vehicle availability with booking systems and maintenance schedules.

Smaller regional players can now rival national chains in efficiency using centralized dashboards, mileage tracking integrations, and predictive maintenance alerts.

Leading car rental companies: What users really say

Based on feedback from discussions like this Reddit thread, users prioritize the following in 2025:

- Transparent pricing and deposit policies

- Easy-to-use mobile booking

- Real-time vehicle tracking and pickup support

- Flexible cancellation and change options

These are not just customer perks. They require well-integrated back-end systems like the Sharefox Booking System that automates reservation changes, enables cancellation logic, and syncs with payment platforms.

Regional winners vs national leaders

While Enterprise, National, and Hertz still dominate nationally, regional players are thriving by focusing on specific value propositions. For instance:

- Eco fleets with electric vehicles

- Peer-to-peer car sharing

- Airport-specific pickups

- Business rentals with monthly invoicing

Platforms like Sharefox Car Rental Software help niche car rental companies stand out by supporting custom pricing models, vehicle categories, and location-specific terms.

Self-service tech defines winners in 2025

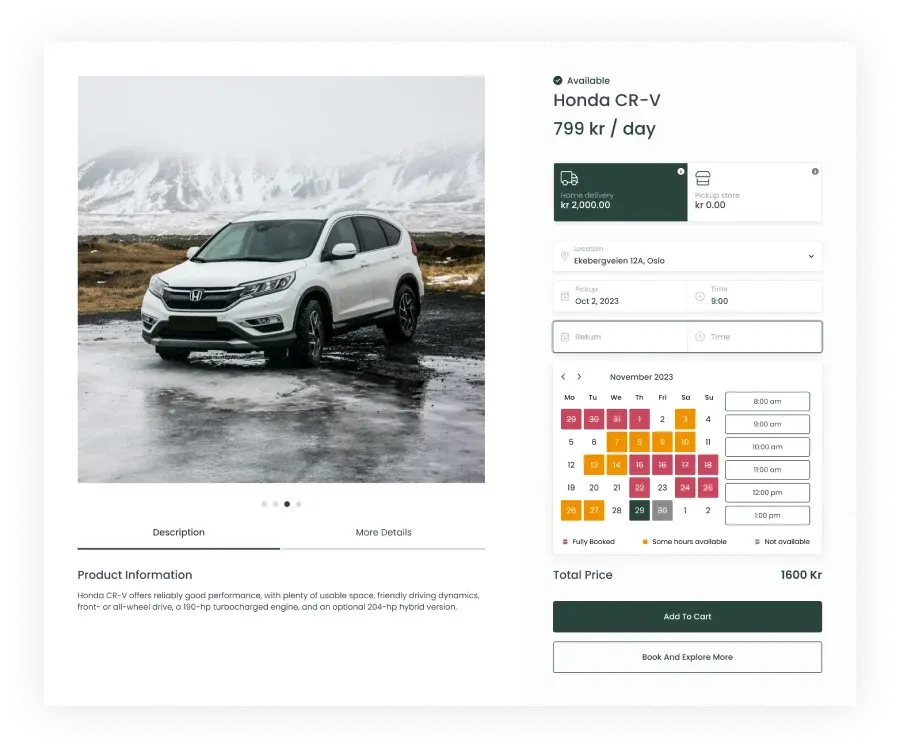

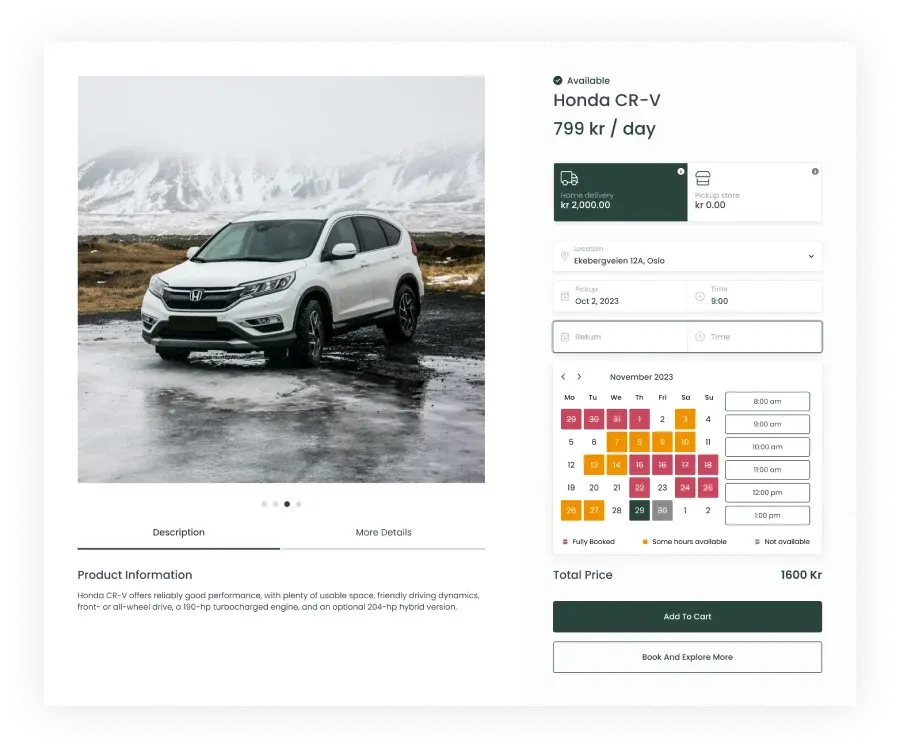

Rental kiosks, mobile-first onboarding, and digital contracts are now expected by travelers. Companies that support self-service rentals using platforms like Sharefox Self-Service Rental gain an edge in reducing check-in time and manual paperwork.

This shift is especially beneficial at smaller airport locations where desk staff availability is low. Automated padlock systems and QR-code-based access reduce overhead while maintaining customer satisfaction.

Subscription-based car rentals on the rise

A growing trend among urban consumers and business users is car subscription models. These services offer monthly rentals with flexible conditions, maintenance, and insurance included.

Platforms like Sharefox Car Subscription Rental Software enable rental providers to configure recurring billing, manage vehicle swap-outs, and apply loyalty discounts — all essential for this new business model.

Logistics and integrations — the invisible battleground

One of the biggest differentiators in 2025 is how well rental companies integrate with logistics services like GPS, insurance APIs, license verification systems, and payment gateways. Sharefox’s broader ecosystem allows:

- Live vehicle tracking

- Automated document verification

- Mobile check-in/out workflows

This creates a seamless experience for users and minimizes admin effort. The Online Rental Store feature also gives companies a ready-to-use frontend that customers can navigate easily.

Highest-rated car rental companies based on customer satisfaction

Independent survey data provides valuable insight into the operational strengths of rental providers. In 2025, Which? conducted a comprehensive evaluation of major rental firms based on transparency, vehicle condition, pricing structure, and customer service.

AutoReisen – 92% satisfaction score

AutoReisen ranked highest with a 92% satisfaction score. Based in the Canary Islands, the company is known for offering fully inclusive pricing, clean and well-maintained cars, and a frictionless booking and pickup process. Although its geographic presence is limited, its operational model represents a benchmark in clarity and reliability.

Cicar – 91% satisfaction score

Also operating in the Canary Islands, Cicar earned nearly identical marks. The firm’s customer policies, vehicle condition, and straightforward documentation made it a standout. Despite some limitations in damage recording, its strong performance across key indicators reinforces its status as a Which? Recommended Provider.

Centauro – 83% satisfaction score

Operating broadly across Southern Europe, Centauro remains a popular option for budget-conscious travelers. The company’s competitive pricing is paired with dependable customer service and generally consistent fleet quality. Customers value its transparency in fuel policies and accurate car descriptions.

Alamo – 73% satisfaction score

Alamo performs reliably in global markets, particularly in the U.S. and the UK. Its success is rooted in consistent customer service, clear billing, and manageable check-in processes. The company maintains a modern digital interface and integrates well with external brokers, offering flexibility for long-term or international users.

Enterprise – 73% satisfaction score

Enterprise is particularly effective in the UK and North America. Though it does not rank as the most affordable, it earns high marks for support and vehicle condition. Its booking workflow and communication are suited to both business and leisure customers. Enterprise’s network scale also ensures availability, even during seasonal peaks.

Hertz – 71% satisfaction score

Hertz remains a fixture in the global car rental landscape. While not topping satisfaction charts, it provides predictable quality and reliable fleet access. The firm supports digital check-in, loyalty programs, and GPS-enabled fleet tracking, enhancing its standing among frequent renters.

How car rental software enhances service delivery

Firms performing well in the Which? survey benefit from tight control of logistics, customer records, and booking systems. Platforms like Sharefox’s car rental software offer modern infrastructure that can be customized across regions, making it easier to:

- Synchronize fleet availability

- Monitor vehicle usage and mileage

- Automate documentation and identity checks

- Integrate fuel and insurance policies into customer-facing interfaces

These features improve clarity and help avoid the types of misunderstandings and delays that lower-rated companies often face.

Digital transparency and customer trust

Many lower-ranked firms in the survey were penalized for aggressive upselling, hidden fees, and vague fuel policies. This underscores the importance of operational transparency, which software platforms must support by design. Tools like Sharefox’s booking system and rental booking software can enforce user-friendly terms and pre-configured pricing displays, reducing ambiguity and increasing trust.

Integrating regional operations with centralized control

For companies operating across multiple geographies, using platforms that scale is essential. Sharefox supports this by allowing firms to configure location-based pricing, fleet segregation, and regional tax compliance under one dashboard. Rental firms serving areas like Spain, the UK, and the Nordics benefit from having unified oversight while maintaining local nuances in vehicle categories and support policies.

Alignment between customer ratings and technical maturity

The companies leading customer satisfaction charts tend to be those that have embraced a tech-enabled, process-focused rental model. These firms offer:

- Consistent vehicle conditions

- Reliable support channels

- Transparent fuel and insurance policies

- Streamlined return processes

By contrast, firms with low satisfaction rates struggle with ambiguous terms, hidden charges, or insufficient customer support. These operational failures are often due to poor backend systems or a lack of digital process maturity.

Next steps for car rental businesses in 2025

To match or exceed industry leaders, rental firms should prioritize:

- Adopting a scalable rental management system like Sharefox

- Automating customer communication and payment flows

- Offering self-service features where possible

- Standardizing fleet tracking and damage recording

These elements are increasingly non-negotiable in a market where customers expect predictability and control.