It’s a sunny Tuesday and someone just dropped off a rented Toyota Corolla at your lot—clean, gassed up, and on time. That’s a good sign. But here’s the bigger question rolling around in the minds of entrepreneurs and operators alike: is this business actually making money?

Whether you’re running a fleet of 50 or just testing the waters with one car on Turo, the idea of making passive (or semi-passive) income from vehicle rentals is tempting. But profitability? That depends on a cocktail of smart planning, local demand, timing, and your ability to dodge the many potholes on the road.

Let’s take this one curve at a time.

The allure of car rental: why everyone’s eyeing the wheel

Think about it—cars are sitting assets. They depreciate, collect dust, and need upkeep whether they move or not. Renting them out gives them purpose.

Platforms like Turo and Getaround have lowered the barrier for entry, while traditional rental shops still serve airports, tourists, and business travelers. Between the two worlds, the car rental business feels like a solid bet.

And, in many ways, it can be.

- Daily rental rates often exceed loan payments.

- Maintenance is predictable if you stay on top of it.

- Technology like car rental software can automate bookings, payments, and even key handovers.

Still, margins vary wildly.

So… how profitable is a car rental business, really?

Here’s the headline stat that often makes the rounds: some operators report net margins of 20–40% once systems are dialed in.

That said, the Sharpsheets blog offers some hard figures to ground expectations:

- Average gross profit margins hover around 40–60%.

- After factoring in depreciation, insurance, maintenance, and platform fees, net profit often falls closer to 10–20% for independent operators.

That might sound small—but compared to many service industries, it’s still solid. Especially when your assets are already sitting in your driveway.

Breaking it down: what eats into your profit?

Ever tried juggling too many bookings during peak season? It’s like playing Tetris… blindfolded. Profitability doesn’t come from volume alone. You have to master your overhead.

1. Depreciation

Your cars lose value the second they hit the street. Buying smart (think Toyota Corolla, Honda Civic) keeps this manageable. Some pros even buy used vehicles to blunt the blow.

2. Insurance

Premiums vary by location, vehicle type, and coverage level. Commercial policies are pricier but often essential. This can chip away at returns fast.

3. Maintenance

Oil changes, brakes, tires—expect $500 to $1,000 in annual upkeep per car. Skip this, and your downtime (and reviews) will tank.

4. Booking platforms & software

If you’re using Turo, they’ll take 15–35% of each booking. Using dedicated booking systems can help you run independently, and ultimately, more profitably.

Different roads: retail vs peer-to-peer models

Let’s take a detour and compare two popular approaches.

A. The Turo Hustle (Peer-to-peer)

From that Reddit thread you shared, many newcomers think, “Buy a car in cash, list it on Turo, and let the money roll in.” Reality check: it’s not that simple.

Here’s the truth:

- Occupancy rates vary heavily by city and season.

- Customer wear-and-tear can be rougher.

- You’re at the mercy of platform algorithm changes.

Still, for side-hustlers, this route is a low-risk way to test the waters.

B. The Traditional Rental Business

More overhead, more control.

If you own or lease a fleet and manage your own bookings via an online rental store, you can:

- Set your own prices

- Collect direct customer data

- Reduce dependency on third-party platforms

Margins are usually higher long-term, but you need systems—like inventory management tools—to stay profitable.

A note on local dynamics

Location is everything.

A car that nets $2,000/month in Los Angeles may scrape $800 in a quieter town. Tourist hubs, college campuses, and urban centers offer better ROI—especially if you niche down (luxury, off-road, or electric).

Scaling your car rental fleet without crashing your margins

Growing a rental business isn’t just about “more cars = more cash.” It’s more like managing a small orchestra—each vehicle (or violin) needs tuning, care, and timing.

Here’s what scaling should look like:

- You start with one or two cars—track performance.

- Once bookings consistently outpace availability, you add more—slowly.

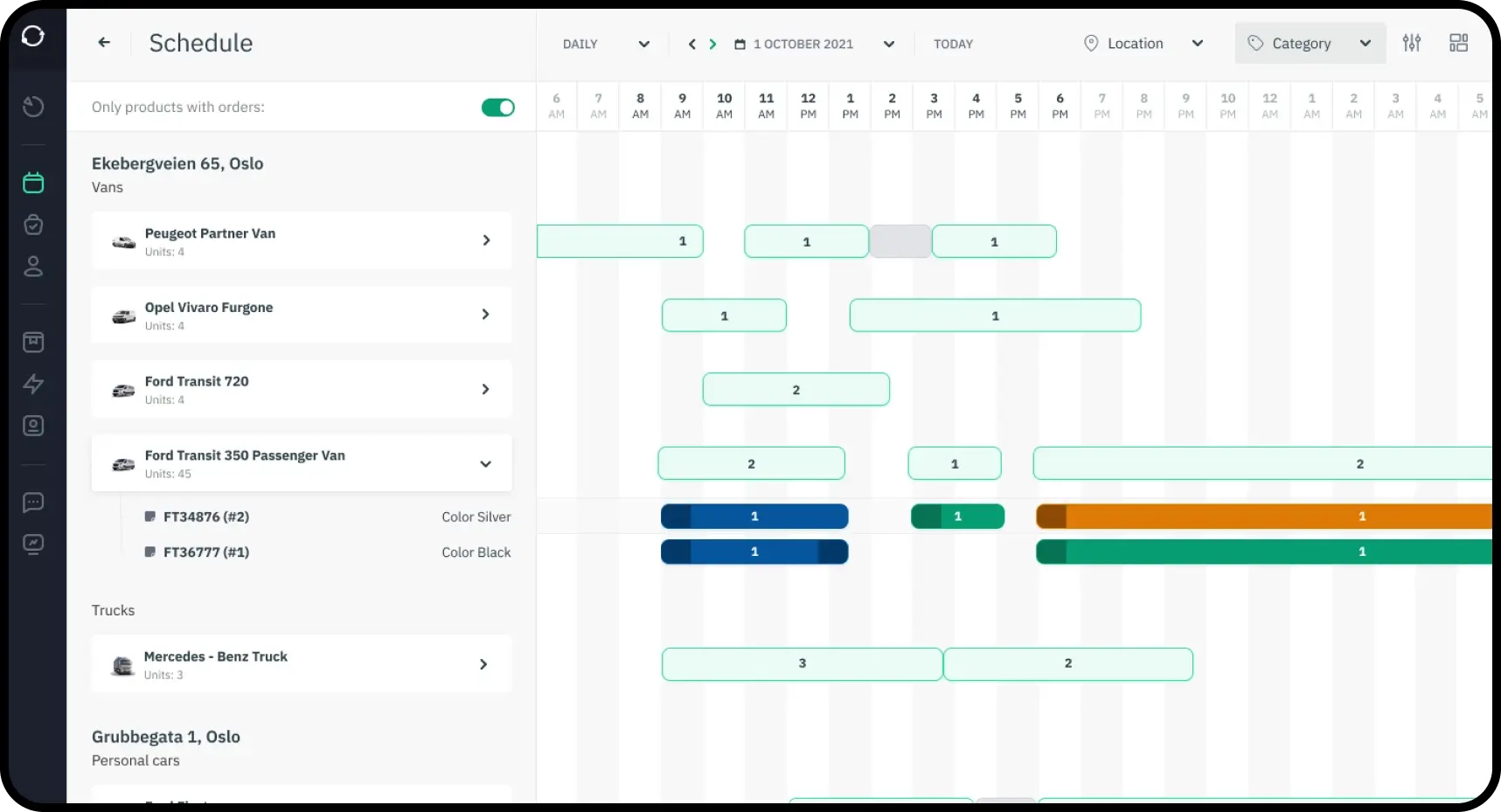

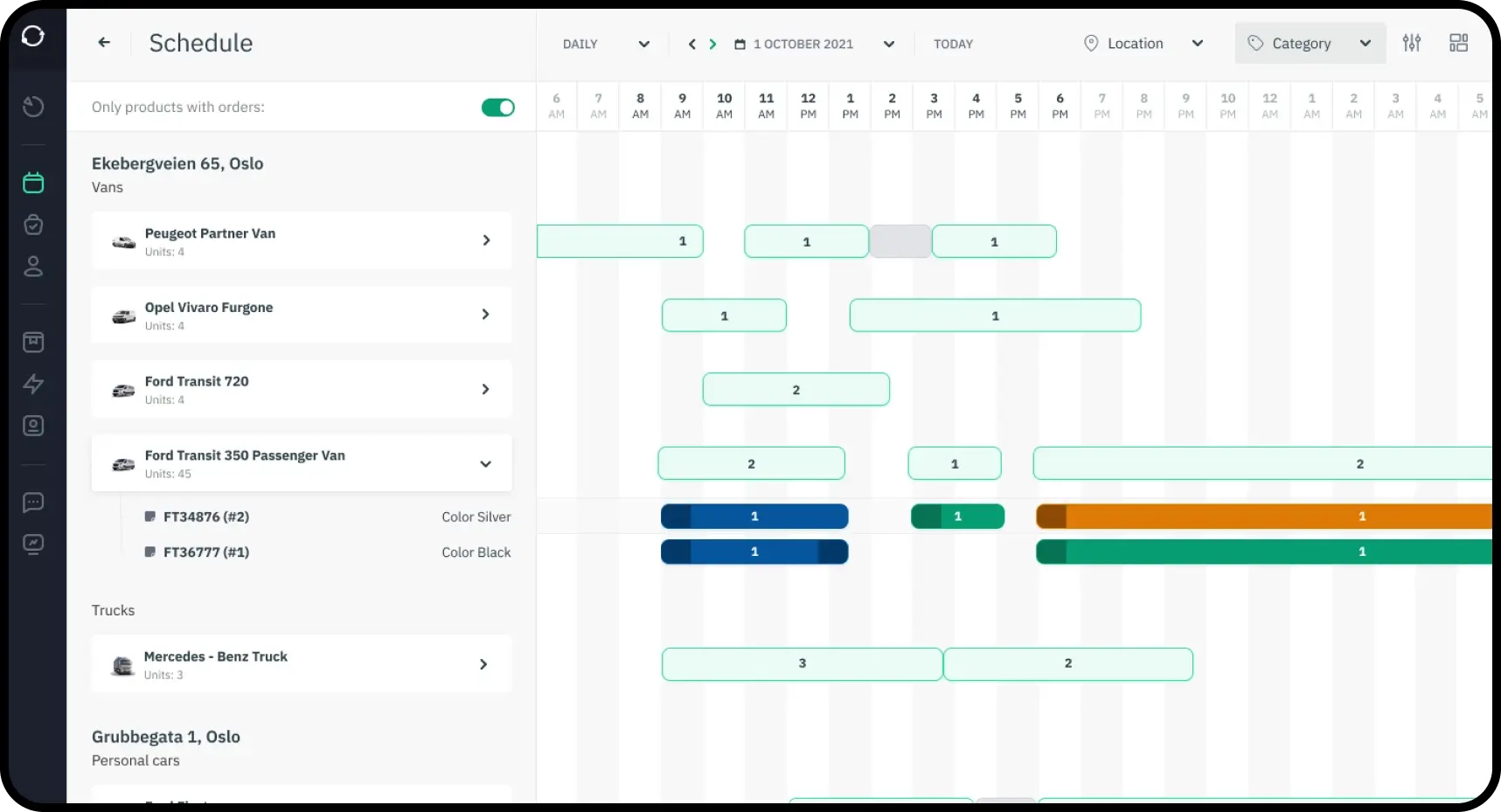

- You use a fleet management system (like Sharefox or Geotab) to stay on top of service schedules, mileage, and rental activity.

And don’t overlook the power of automation.

The best businesses automate:

- Booking confirmations

- Payment collections

- Pickup and return instructions (especially if using self-service padlocks)

- Maintenance reminders

If you’re manually texting clients or updating spreadsheets daily, you’re burning time—and profits.

The underrated power of niche targeting

Ever heard of someone renting out just Tesla Model 3s or Sprinter vans for touring bands?

It works.

Choosing a niche lets you:

- Charge premium rates

- Reduce your marketing noise

- Stand out in crowded cities like Miami or L.A.

Need proof?

Check out how Turo Power Hosts focus on themed fleets—like eco-rides or convertibles in sunny cities—to dominate search results and reviews.

You can use platforms like:

- Turo Calculator to estimate income based on city and car type

- Or create your own online rental website to attract direct bookings

Profit automation: set it and (almost) forget it

Let’s be honest. No one wants to spend their Sundays cleaning cars or chasing late returns.

With the right tech stack, you can turn your rental hustle into a smooth operation:

Use these:

Once this setup is running, you can manage a 10+ car fleet solo—or with minimal support.

Taxes, licensing, and the boring but essential stuff

OK, time for the “broccoli” part. Not fun, but crucial for sustainability.

Here’s what you must sort out:

1. Business Registration

Depending on your country or state, you may need:

- LLC (US)

- VAT registration (EU)

- Commercial rental license (city-specific)

2. Insurance

Don’t rely on personal car insurance. Use commercial auto coverage or let platforms like Turo cover bookings under their protection plans.

3. Accounting Tools

Use apps like QuickBooks or Xero to track:

- Income vs. expenses

- Depreciation per car

- Mileage write-offs

Your accountant will thank you (and so will your future self come tax season).

Can you actually make a living renting cars?

Short answer? Yes—with intention.

If you treat it like a business, not a side hustle, the numbers stack up:

| Fleet Size |

Monthly Revenue (avg) |

Monthly Expenses |

Net Profit |

| 1–2 cars |

$1,500–$3,000 |

$800–$1,200 |

$700–$1,800 |

| 5–10 cars |

$8,000–$18,000 |

$4,000–$9,000 |

$4,000–$9,000 |

| 20+ cars |

$30,000+ |

Varies |

20–40% margins if well-run |

Source: Sharpsheets report on car rental profitability

Real people, real risks

From Reddit’s Turo community, here’s what actual hosts say:

“It can be profitable, but it’s not passive. Between cleaning, logistics, and claims, be ready to hustle.”

“If you’re buying a car with a loan and expecting it to pay for itself plus profit from Day 1, rethink that.”

Key takeaway? Start small. Use data. Automate everything you can. And always plan for the “what-ifs”—like an accident, a low season, or sudden platform policy changes.

Tools that turn chaos into cashflow

Don’t go it alone. Whether you’re a solopreneur or a fleet manager, the difference between burnout and growth often comes down to the software you choose.

Final thoughts: Profit comes from the process

Making money in the car rental business isn’t about finding the right car—it’s about building the right system. If you treat each vehicle like a mini business and use the tools at your disposal, the profits tend to follow.

And the best part? Once you’ve dialed in the systems, the sky’s the limit. You can go from parking-lot side hustle to full-on mobility operation—all while sipping your morning coffee.

Ready to turn your fleet into freedom?

Book a free Sharefox demo and see how we help rental businesses scale smarter.