Introduction to Rental Insurance

Rental insurance is essential for any business involved in the rental industry. It protects your assets, reduces liability, and ensures smooth operations. Whether you rent out heavy machinery, vehicles, or party supplies, having the right insurance coverage is crucial.

Why Rental Insurance is Vital

- Asset Protection: Rental insurance safeguards your valuable rental items against damage, theft, or loss.

- Liability Coverage: It protects your business from potential lawsuits arising from accidents or injuries caused by your rental equipment.

- Operational Continuity: Insurance ensures that your business can continue operating smoothly, even in the event of unforeseen incidents.

Types of Rental Insurance

- General Liability Insurance: Covers bodily injury and property damage caused by your rental equipment.

- Commercial Property Insurance: Protects your business property, including your rental inventory, against risks like fire, theft, and vandalism.

- Business Interruption Insurance: Compensates for lost income and operating expenses if your business is temporarily closed due to a covered event.

- Equipment Breakdown Insurance: Covers the cost of repairing or replacing damaged rental equipment due to mechanical failure.

How to Choose the Right Rental Insurance

- Assess Your Risks: Identify potential risks and liabilities associated with your rental business.

- Compare Coverage Options: Evaluate different insurance policies to find the one that best suits your needs.

- Consider the Cost: Balance the coverage benefits against the premium costs to ensure affordability.

Best Practices for Managing Rental Insurance

- Regularly Review Policies: Keep your insurance policies up to date to reflect any changes in your rental inventory or business operations.

- Maintain Accurate Records: Document all rental transactions and incidents to support any future insurance claims.

- Train Your Staff: Ensure your employees understand the insurance policies and procedures to handle equipment and manage risks effectively.

Common Challenges in Rental Insurance

- High Premiums: Rental businesses often face high insurance premiums due to the increased risk of damage or theft.

- Coverage Gaps: Ensuring comprehensive coverage can be challenging, as some policies may exclude certain types of equipment or risks.

- Claim Denials: Insurance claims can be denied if proper documentation is not maintained or if the incident is not covered under the policy.

Overcoming Insurance Challenges

- Work with Experienced Brokers: Partner with insurance brokers who specialize in rental insurance to find the best coverage options.

- Bundle Policies: Consider bundling different insurance policies to reduce premiums and ensure comprehensive coverage.

- Implement Risk Management Strategies: Adopt preventive measures like regular maintenance and employee training to minimize risks and claims.

The Future of Rental Insurance

- Technological Advancements: Innovations like IoT and telematics can help monitor rental equipment, reduce risks, and lower insurance costs.

- Customized Policies: Insurers are developing more tailored policies to meet the unique needs of different rental businesses.

- Sustainable Practices: As businesses focus on sustainability, insurance companies are offering coverage for eco-friendly practices and equipment.

Conclusion

Investing in the right rental insurance is crucial for the success and sustainability of your rental business. By understanding the different types of coverage, assessing your risks, and implementing best practices, you can protect your assets and ensure smooth operations. For more detailed insights, visit our rental software and online rental website builder.

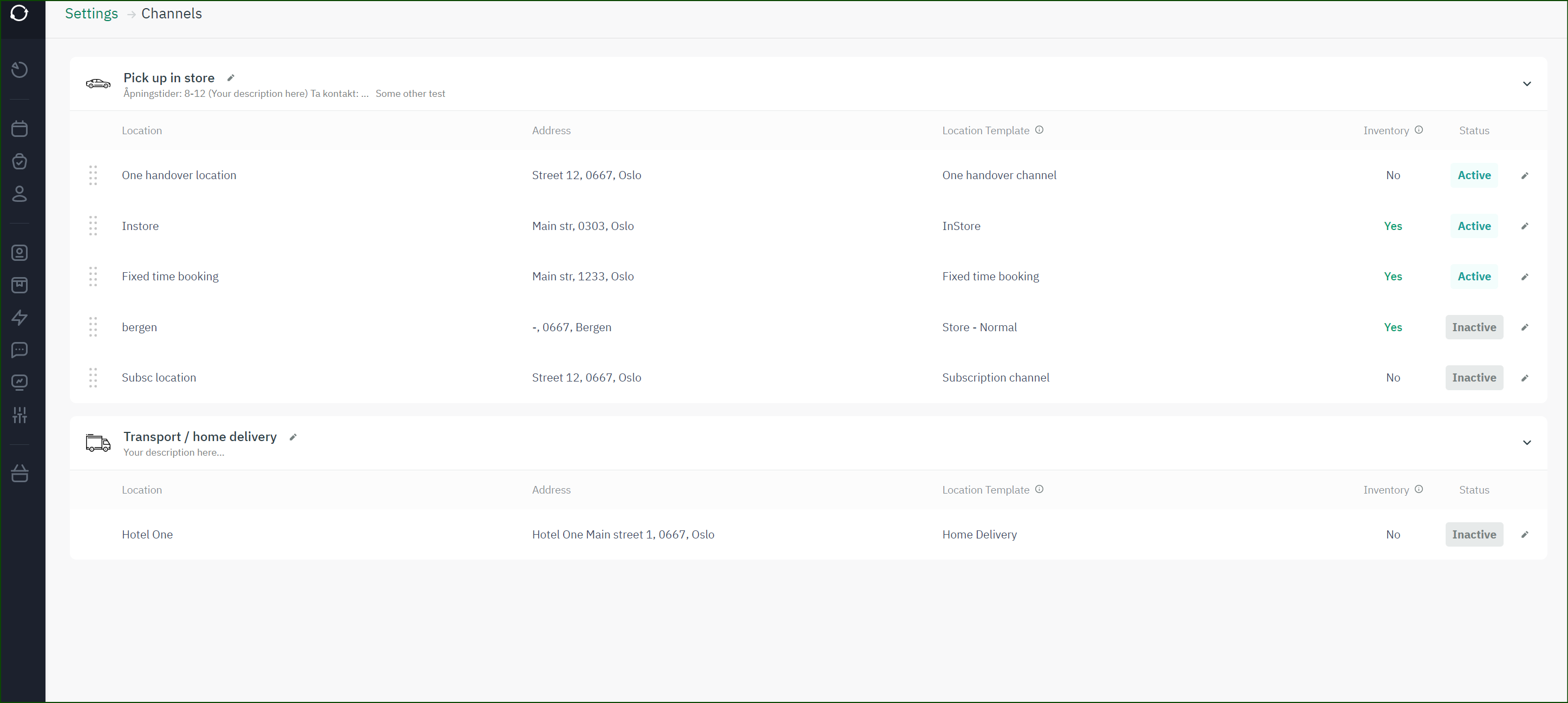

Understanding Your Administration Page

To manage your rental business efficiently, it’s essential to understand your administration page. This page provides a comprehensive overview of your inventory, orders, and customer interactions.

How to Manage Products

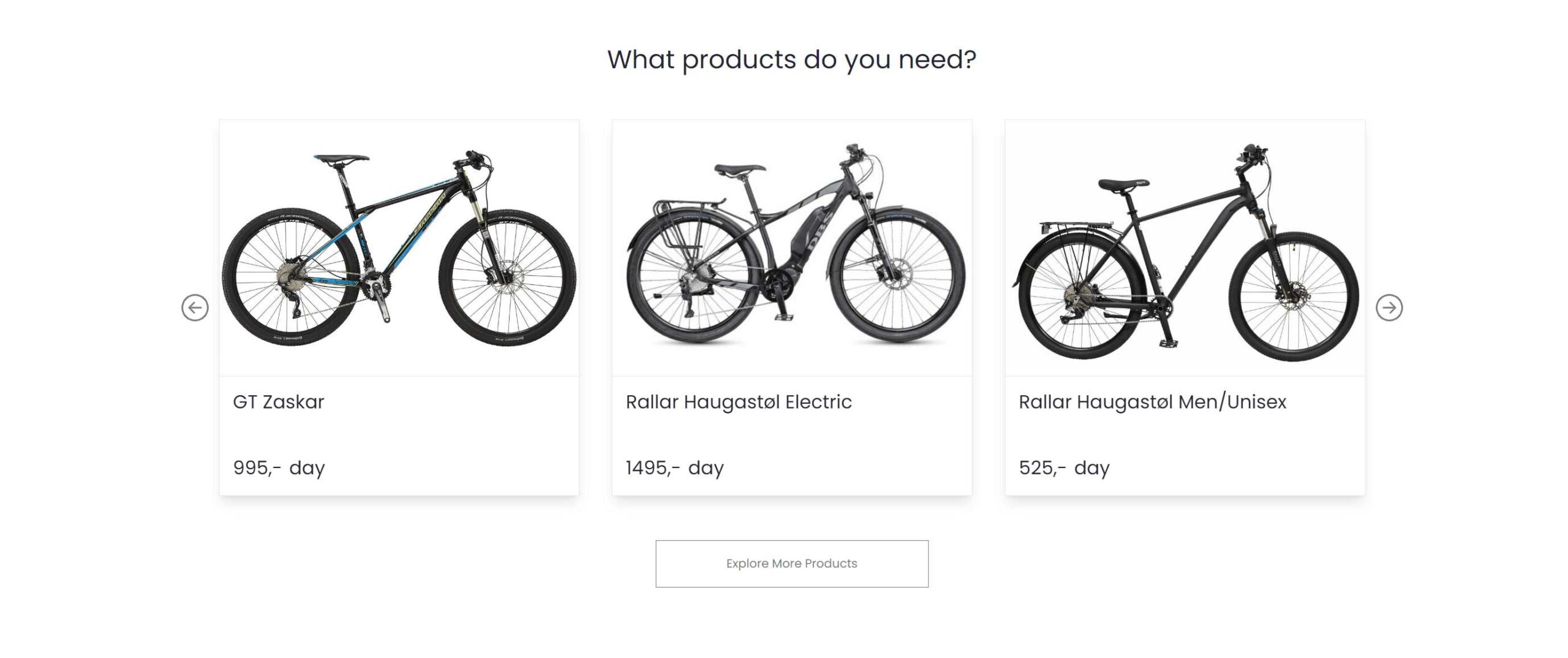

Effective product management is key to a successful rental business. Learn how to manage your products efficiently to keep your inventory updated and ensure customer satisfaction.

Optimizing Your Rental Site

An optimized rental site attracts more customers and increases bookings. Follow our guide on how to optimize your rental site for best practices and tips.

Building a Rental Page

Creating a stunning rental page is crucial for your online presence. Our step-by-step guide on how to build a rental page will help you design a user-friendly and attractive site.

Enhancing Customer Experience

Customer satisfaction is paramount in the rental business. Learn how to enhance your customer experience with our Kayak Rental Software guide.

Booking Calendar

A booking calendar is an essential tool for managing your rental bookings. Discover how a booking calendar can help you handle more customers and reduce manual tasks.

Inventory Management

Keeping track of your rental inventory is crucial for smooth operations. Learn more about our Inventory Rental Management System to streamline your inventory tracking process.

Reporting and Analytics

Gain insights into your rental performance with our reporting and analytics tools. Visit our Rental Software page for more information on how to leverage data for your business growth.

By implementing these strategies and utilizing the resources provided by Sharefox, you can ensure the success and growth of your rental business. For further assistance, contact us or explore our Academy for more detailed guides and tutorials.

FAQs

-

What is rental insurance?

Rental insurance protects rental businesses from financial losses due to damages, theft, or liability issues involving their rental equipment.

-

Why is rental insurance important?

It provides financial protection for your assets, reduces liability, and ensures operational continuity in case of unexpected incidents.

-

What types of rental insurance are available?

Common types include general liability insurance, commercial property insurance, business interruption insurance, and equipment breakdown insurance.

-

How do I choose the right rental insurance?

Assess your risks, compare coverage options, and consider the cost to find a policy that best suits your business needs.

-

What are common challenges in rental insurance?

High premiums, coverage gaps, and claim denials are common challenges faced by rental businesses.

-

How can I manage rental insurance effectively?

Regularly review policies, maintain accurate records, and train staff on insurance procedures and risk management strategies.

For more information visit:

-

Insurance Information Institute (III)

- URL: www.iii.org

- Purpose: To provide readers with general information about insurance, including types of insurance and industry insights.

-

National Association of Insurance Commissioners (NAIC)

- URL: www.naic.org

- Purpose: To offer regulatory information and guidelines on insurance policies and practices.

-

Small Business Administration (SBA)

- URL: www.sba.gov

- Purpose: To provide resources and information for small business owners, including guidance on business insurance.

-

American Rental Association (ARA)

- URL: www.ararental.org

- Purpose: To offer industry-specific resources, news, and insights for rental businesses.

-

Forbes – Small Business Insurance Guide

- URL: www.forbes.com

- Purpose: To give readers a comprehensive guide on small business insurance options and considerations.

-

Entrepreneur – Business Insurance Basics

- URL: www.entrepreneur.com

- Purpose: To provide an overview of essential business insurance types and tips for selecting the right coverage.